Bitcoin’s price action could remain sluggish into September as two major events threaten to add significant selling pressure to the market.

Mt. Gox Repayments

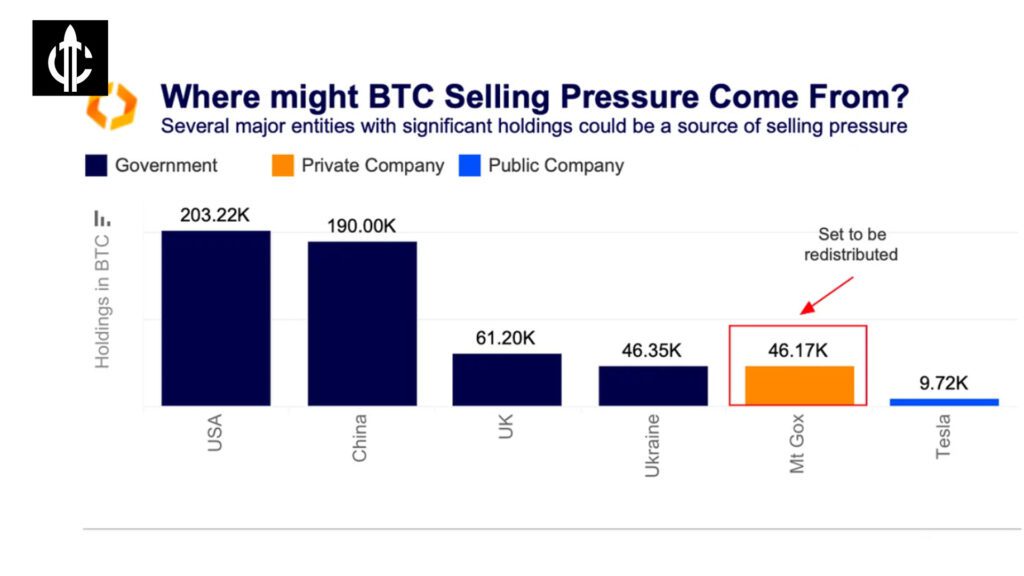

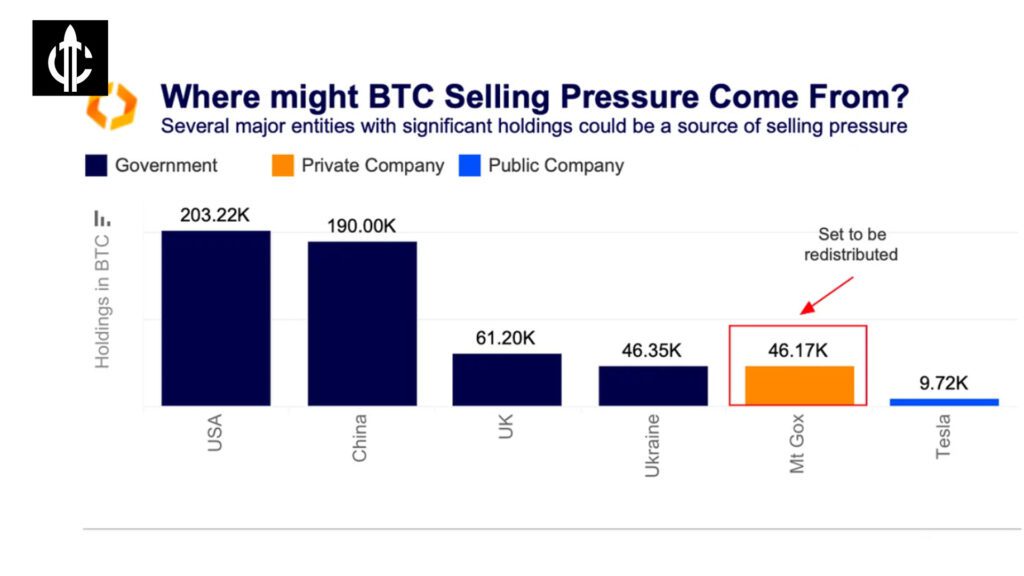

The defunct cryptocurrency exchange Mt. Gox is set to distribute over 46,000 Bitcoin worth $2.7 billion to creditors by the end of 2024. While this amount is unlikely to cause major disruptions according to crypto analytics firm Kaiko, it represents a substantial amount of BTC that could hit exchanges.

Mt. Gox creditors have been waiting over a decade to receive their funds, which have appreciated over 8,500% in value since the exchange collapsed in 2014. Many creditors may look to sell at least a portion of their holdings.

However, when Mt. Gox distributed nearly $4 billion worth of Bitcoin to creditors in July, most opted to hold rather than sell. The spot cumulative volume delta (CVD) on Kraken, where the funds are being distributed, did not see a significant spike after the distribution.

US Government Bitcoin Holdings

In addition to the Mt. Gox overhang, the US government holds over 203,000 Bitcoin worth $12.1 billion. While it’s unclear if or when the government plans to sell these seized assets, their entry into the market could put further downward pressure on prices.

Bitcoin Price Outlook

Bitcoin’s price remains below the $60,000 psychological resistance level after falling over 10.7% in August. To end the month in positive territory, BTC needs to close above $64,300.

Analysts warn that the typically low liquidity of the summer months could persist into September, making it difficult for Bitcoin to overcome the $63,900 resistance level. This is close to the short-term holder realized price, suggesting some profit-taking from this cohort.

Historically, September has been a weak month for Bitcoin, with average returns of -4.78% since 2013. The combination of the Mt. Gox repayments and potential US government selling could exacerbate this seasonal weakness.