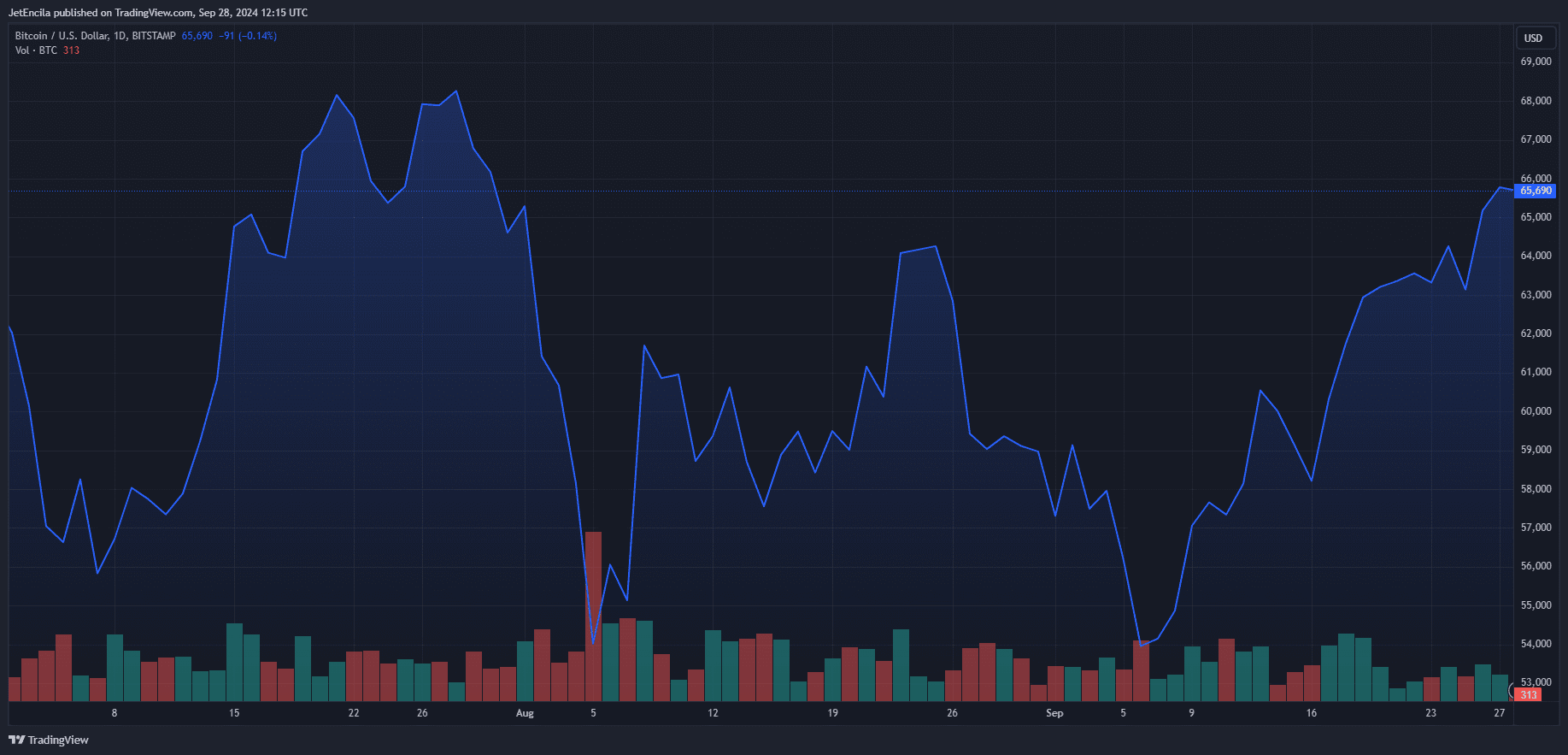

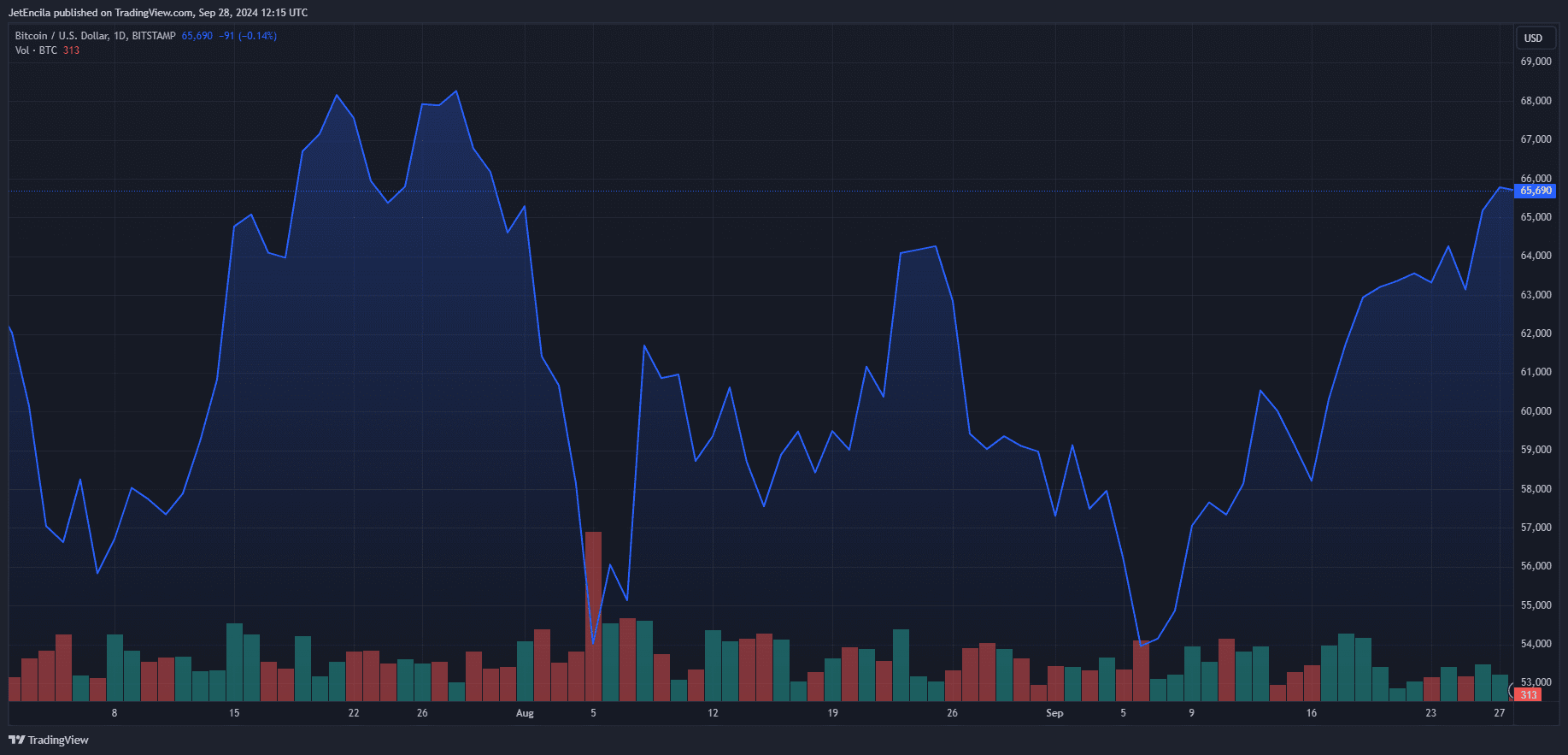

Bitcoin, the world’s top cryptocurrency, has seen a strong rise in value over the past two weeks, surprising many traders and experts. This increase has pushed Bitcoin’s price back above $65,000. On September 6, Bitcoin dropped to a low of $52,820. However, it has bounced back by 25.5%, reaching $66,300, making it one of its best September performances since 2013.

Even with this impressive rise, many traders are still betting that Bitcoin’s price will fall. This creates the chance for a Bitcoin short squeeze, which could push the price to new all-time highs in October. Let’s explore what this means and why Bitcoin’s price might go even higher soon.

Short Positions Lead on Exchanges

Crypto analyst Ali Martinez recently shared on X (formerly Twitter) that 57.77% of Binance users are betting against Bitcoin. This means many traders believe Bitcoin’s price will fall, even though it’s currently rising.

However, large investments from institutions, especially through Spot Bitcoin ETFs, suggest that Bitcoin’s price could keep going up. With many short traders betting on a drop and big buyers entering the market, this could lead to a Bitcoin short squeeze. In a short squeeze, traders who bet on the price falling are forced to buy back at higher prices, making the price rise even more.

Could Bitcoin Break Its All-Time High?

As Bitcoin moves into October, a month often called “Uptober” for its strong performance, many traders and experts believe it could break its previous record of $73,737. Bitcoin has a history of doing well in the last part of the year, boosted by big investments and more buying.

In this situation, a Bitcoin short squeeze could push prices even higher. Analysts are watching the market closely for signs that this might happen. If it does, Bitcoin’s price could rise to new levels, possibly going beyond its previous record.

Short-Term Correction Ahead?

While the overall view on Bitcoin is positive, some signs point to a possible short-term price drop. Ali Martinez noted that the TD Sequential indicator, which helps predict price changes, has shown a “sell” signal on Bitcoin’s 4-hour chart. This could mean a small price dip before the next rise.

A short-term drop would allow the market to settle before another big upward move. If the price falls, more traders might bet against Bitcoin, which could make the expected short squeeze even stronger when the price rebounds.

Right now, Bitcoin is trading around $65,658, and everyone is watching to see if the short squeeze will push it past its all-time high.

Conclusion: Will Bitcoin Soar Higher?

The current market shows that Bitcoin’s price is about to make a big move, with a possible short squeeze coming soon. As more institutions invest and many traders bet against Bitcoin, the chances of it reaching new all-time highs are growing. Even if there are some short-term drops, the overall feeling is positive as Bitcoin enters its traditionally strong fourth quarter.

Join Our Telegram Free Channel for Free Crypto Singals and Charts: t.me/coinextoday