The intersection of politics and financial markets often yields surprising results, particularly in the volatile world of cryptocurrency. Recent events surrounding the debate between U.S. presidential candidates Kamala Harris and Donald Trump have demonstrated this dynamic vividly. Following the debate, which polls indicated Harris won, crypto and Bitcoin mining stocks experienced a notable recovery from an initial dip. This article will explore the implications of the debate on the crypto market, the performance of specific stocks, and the broader trends affecting the industry.

The Impact of Political Events on Crypto Stocks

Key Aspects of the Debate’s Influence

On September 11, 2024, the debate between Harris and Trump led to immediate reactions in the stock market, particularly for crypto-related companies. Harris’s performance, as indicated by various opinion polls, appeared to resonate positively with voters, leading to a rebound in crypto stocks after an initial decline.

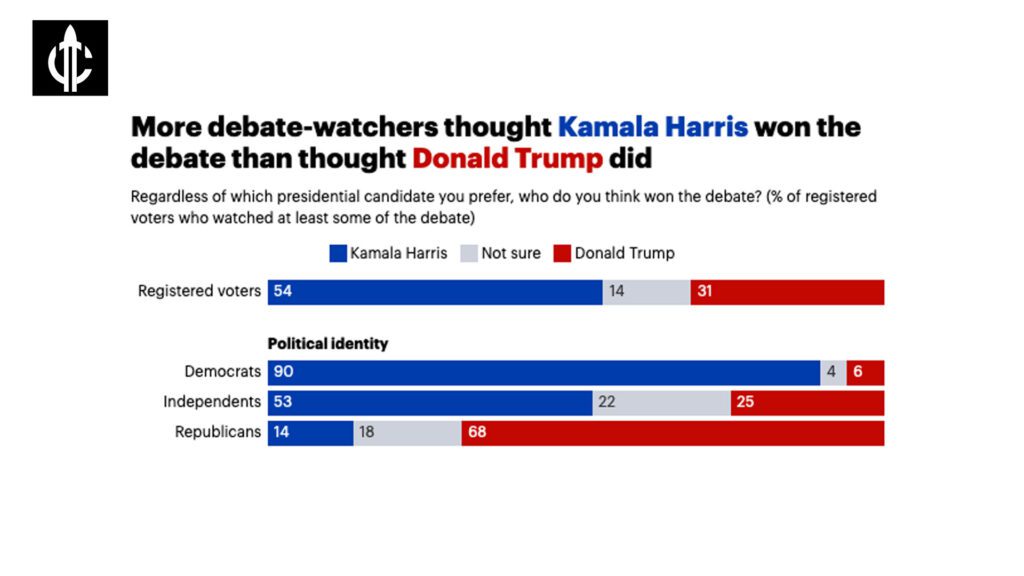

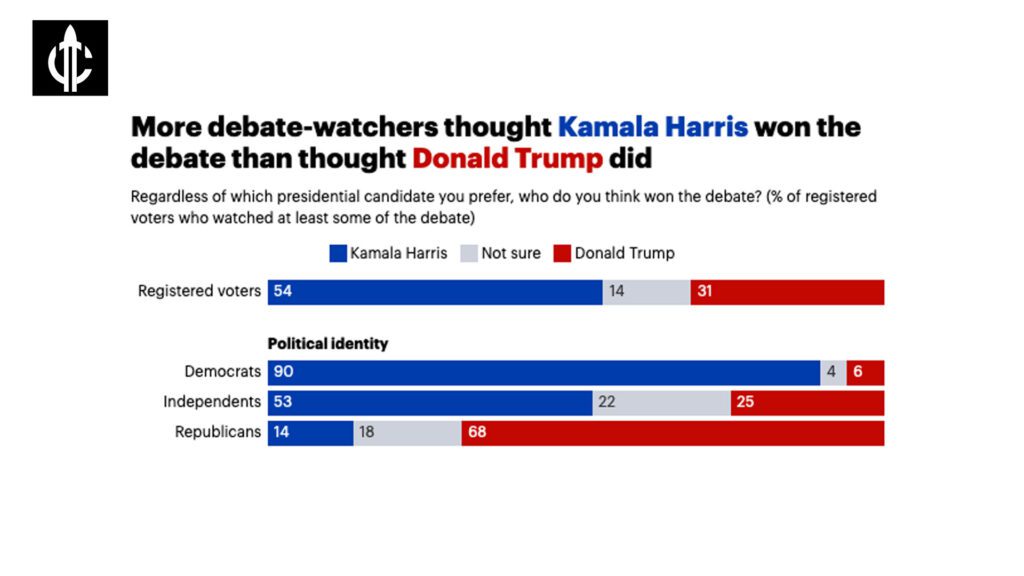

- Poll Results: A YouGov survey revealed that 54% of registered voters believed Harris won the debate, while only 31% favored Trump. This perception likely influenced investor sentiment in the crypto sector.

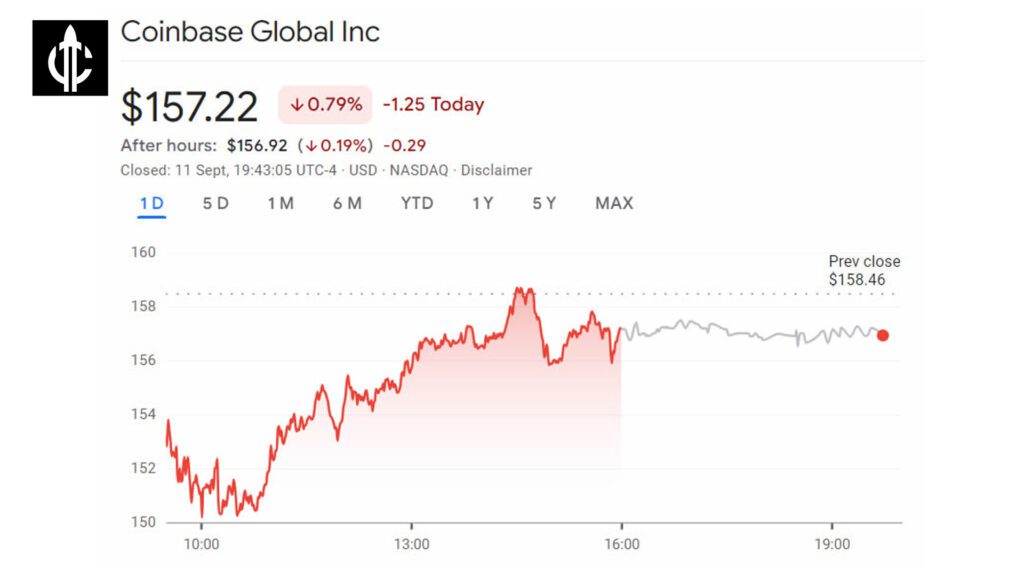

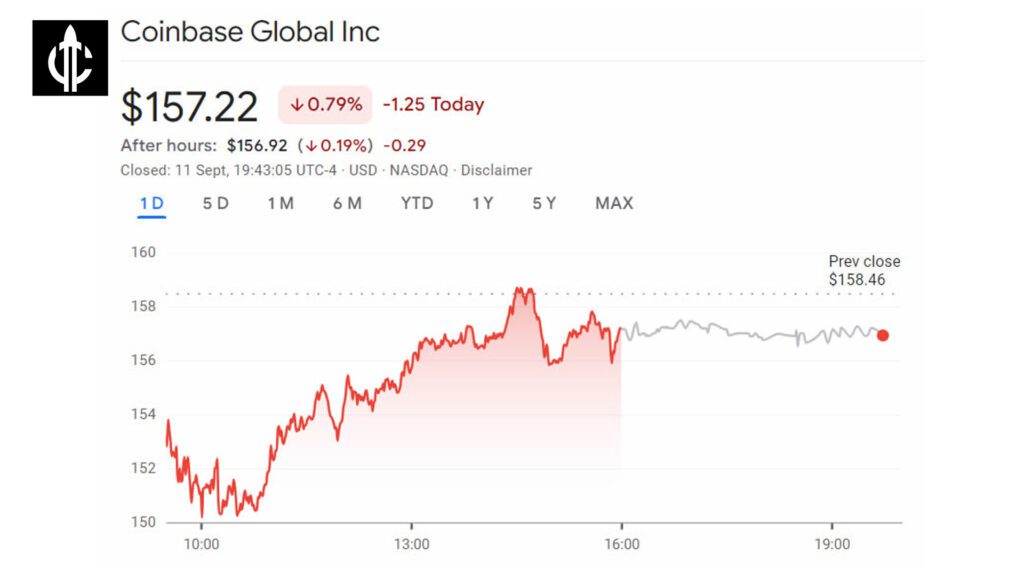

- Market Reaction: Following the debate, crypto stocks initially dipped but later showed signs of recovery. For instance, Coinbase (COIN) saw its share price drop to $150 before rebounding to close at $157.22, a decline of only 0.79% for the day.

Case Studies: Performance of Key Stocks

- Coinbase (COIN): After dipping to $150, Coinbase’s shares regained 5.3% in after-hours trading, reflecting investor confidence despite the initial downturn.

- MicroStrategy (MSTR): This Bitcoin-buying firm experienced a slight decline, closing down 0.26% at $129.30 after hitting a low of $122.

- Marathon Digital (MARA) and Riot Platforms (RIOT): Both companies saw early drops but managed to recover slightly, closing down 0.94% and 2.07%, respectively.

- Hut 8 (HUT): Uniquely, Hut 8 closed up 1.29% at $10.58, indicating strong resilience amid the market fluctuations.

Best Practices for Investors in a Volatile Market

Strategies for Navigating Political Influences

Investors in the cryptocurrency space should adopt strategies to navigate the inherent volatility, especially during politically charged events:

- Stay Informed: Regularly follow news related to political events and their potential impact on market sentiment. Understanding the political landscape can help anticipate market movements.

- Diversify Investments: Spread investments across various crypto assets and related stocks to mitigate risks associated with sudden market shifts.

- Set Clear Entry and Exit Points: Determine specific price levels for buying and selling to avoid emotional decision-making during volatile periods.

Actionable Tips

- Utilize Stop-Loss Orders: Implement stop-loss orders to protect investments from significant downturns during politically influenced volatility.

- Engage with Community Insights: Participate in forums and social media discussions to gauge market sentiment and gather diverse perspectives on political impacts.

Advanced Considerations for Crypto Investors

Implications of Political Outcomes on Crypto Policies

The political landscape can significantly influence cryptocurrency regulations and market conditions. Here are some advanced considerations:

- Policy Promises and Market Reactions: Trump’s pro-crypto stance has historically garnered support from the crypto community. In contrast, Harris’s position remains less defined, which could lead to uncertainty in market reactions based on future policy announcements.

- Long-Term Trends: Monitor national polling and public sentiment towards candidates, as these factors can shape the regulatory environment for cryptocurrencies. For instance, if Harris’s policies become more favorable towards crypto, it could bolster market confidence.

- Memecoins and Market Sentiment: The performance of Trump-themed memecoins, which saw significant declines post-debate, illustrates how political events can impact niche segments of the crypto market.

Conclusion

The recent debate between Kamala Harris and Donald Trump has highlighted the intricate relationship between politics and cryptocurrency markets. While initial reactions led to a dip in crypto stocks, the subsequent recovery indicates resilience among investors. As political events continue to shape market dynamics, staying informed and adopting strategic investment practices will be crucial for navigating this volatile landscape.

Join Our Free Telegram Channel for Free Crypto Signals and Charts: t.me/coinextoday

FAQs

- How do political debates affect cryptocurrency stocks?

Political debates can influence investor sentiment, leading to fluctuations in stock prices based on perceived performance and policy implications. - What are some strategies for investing in crypto during volatile times?

Strategies include staying informed about political events, diversifying investments, and setting clear entry and exit points. - Why did crypto stocks recover after the initial dip?

The recovery was driven by positive sentiment towards Kamala Harris’s debate performance, which reassured some investors about the political landscape’s impact on crypto policies. - What should investors watch for in future political events?

Investors should monitor candidate positions on cryptocurrency regulations and market sentiment in response to political developments.