An unexpected on-chain transaction recently caught the crypto community’s attention when 30,000 BTC, valued at approximately $1.88 billion at current prices, was moved to Binance, the world’s largest cryptocurrency exchange. The data, sourced from Whale Alert, highlighted the scale and secrecy of this massive transfer, prompting immediate speculation and concern among market participants.

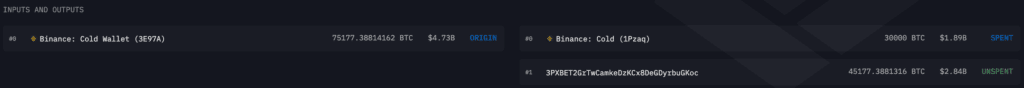

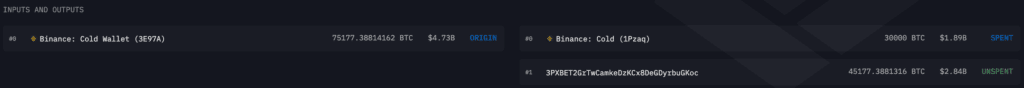

The transfer originated from the Bitcoin address “3E97A,” which initially sent a staggering 75,177.38 BTC, worth around $4.73 billion, to two separate addresses: “3PXBET” and “1Pzaq.” The latter address, “1Pzaq,” was identified as a Binance cold wallet, which received the 30,000 BTC portion of the original transaction.

Following this, the transaction history shows that 233 BTC were transferred to another Binance cold wallet. Meanwhile, the remaining 45,177 BTC that landed in the address “3PXBET” have not been moved since, remaining untouched in this wallet.

Top 8 Token Unlocks to Watch on September 1

read more

Such significant transfers often create fear, uncertainty, and doubt (FUD) in the market, as large movements of Bitcoin to an exchange typically suggest an impending sell-off by a large entity. However, this mix of addresses and transactions paints a different picture when delving deeper into on-chain data.

Data from Arkham Intelligence reveals that both the sending address and the receiving address (which received the 30,000 BTC) are controlled by Binance, indicating that this was merely an internal transfer between the exchange’s own cold wallets. The sending address, “3E97A,” also appears to be a Binance cold wallet. This clarifies that the transaction was a technical maneuver rather than a preparation for a massive sell-off.

Also Read: How to Buy Cryptocurrency on Kraken crypto trading platform: A Beginner’s Guide

Despite the internal nature of this transfer, the market’s reaction was swift. Upon noticing the large Bitcoin deposit on Binance, traders reacted with caution, leading to a sudden price drop. Within a minute, Bitcoin’s price fell by 0.44%, forming a significant red candle on the charts. However, it’s worth noting that Bitcoin’s price had already been declining for the past two days, and this event merely accelerated the ongoing downward trend.

In conclusion, while large transactions like these can stir anxiety among investors, understanding the context behind them is crucial. In this case, the movement was simply a Binance internal transfer, with no immediate cause for concern. For more insights and updates on cryptocurrency movements, visit our website at CoinEx Today.

Also Read: Top Cryptocurrency to Buy Before It Soars 6,200%, According to Cathie Wood of Ark Invest

Join our Telegram Channel for Free Crypto Signals and Charts: t.me/coinextoday