Bitcoin begins the week in the red, despite Federal Reserve’s comments on future interest rate cuts. Traders remain optimistic for a bullish Q4.

Bitcoin opened the week with a sharp sell-off, dropping to $63,000 as the Federal Reserve’s hints about future rate cuts failed to reverse the downward trend. Despite this setback, Bitcoin is still on track to close Q3 with positive returns, leaving traders hopeful for a bullish Q4.

Bitcoin Falls to $63K Amid Rate Cut Speculation

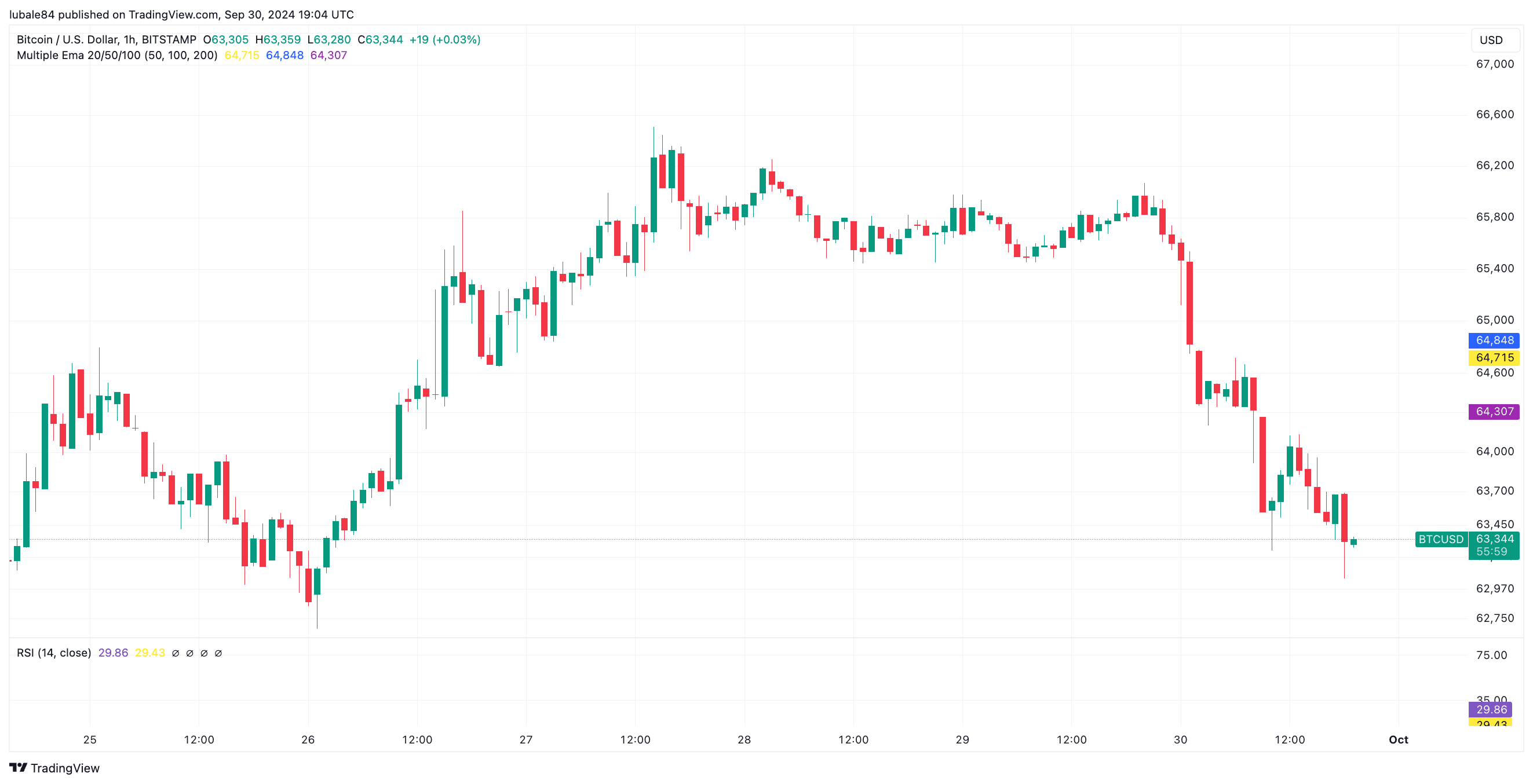

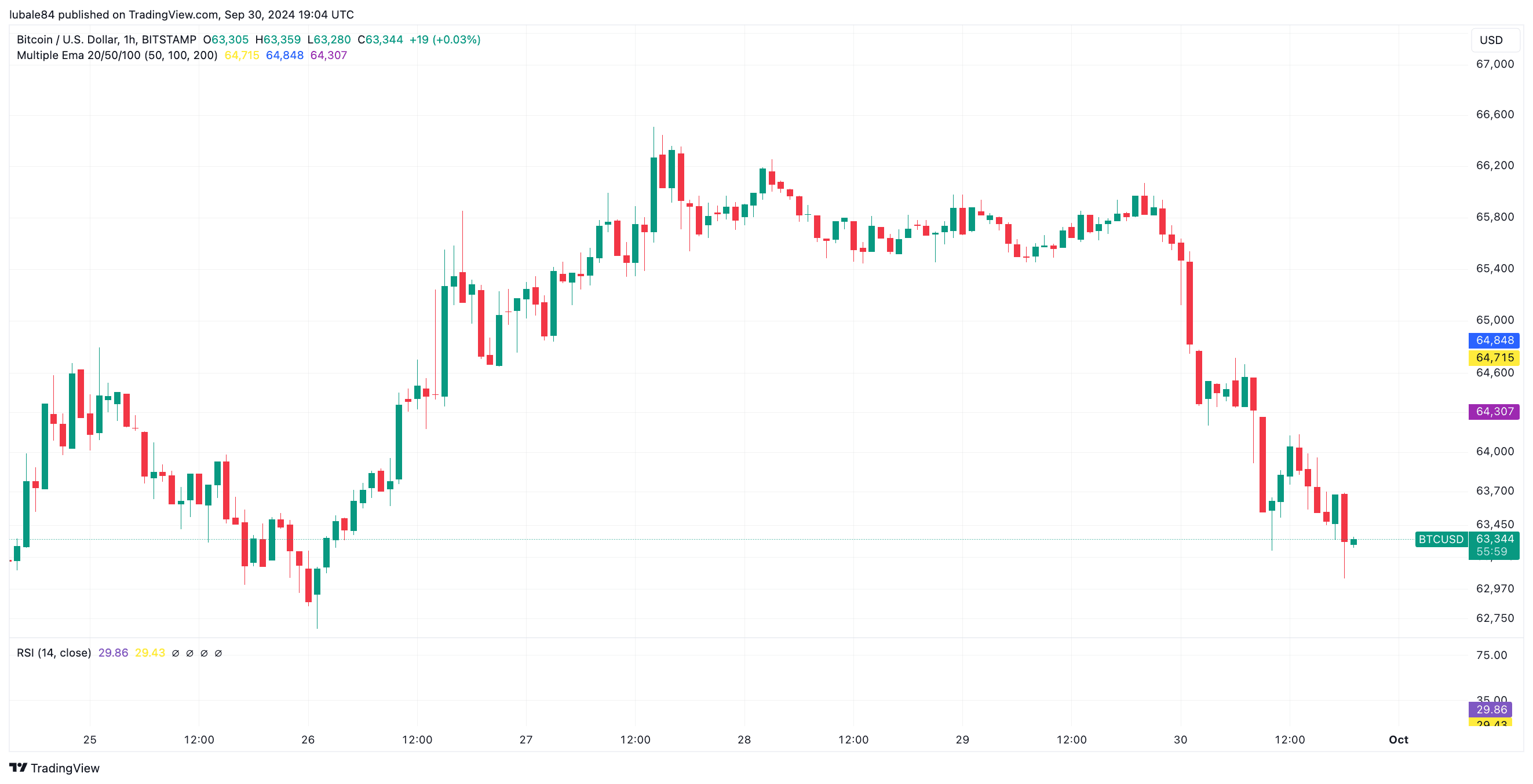

On September 30, Bitcoin’s price dropped from $65,634 to an intraday low of $63,049, marking a 4% decline, according to data from Cointelegraph Markets Pro and TradingView. At the time of writing, Bitcoin is trading around $63,344, down 3.6% over the last 24 hours.

Federal Reserve’s Plans for Rate Cuts

The market was closely watching Federal Reserve Chair Jerome Powell’s speech in Nashville. Powell said the Federal Reserve plans to lower interest rates two more times in 2024, but these cuts will likely be smaller—around 0.25% each time. He also made it clear that the Fed is not in a hurry to make big cuts to the rates.

“We’re not on any preset course. The risks are two-sided, and we will continue to make decisions meeting by meeting,” Powell explained.

This follows the Fed’s recent 50 basis point rate cut, the first since March 2020. Futures markets are predicting a more cautious approach at the Fed’s November meeting, with a quarter-point reduction likely. However, traders are bracing for a more aggressive cut in December, with CME Group’s FedWatch Tool putting the odds of a 0.5% rate cut at 48%.

Traders Eye a Bullish Q4 for Bitcoin

Despite the current downtrend, Bitcoin traders remain optimistic about Q4. Historically, September has been a bearish month for Bitcoin, with a 11% drop at the beginning of the month. However, the price rebounded following the Fed’s September rate cut.

According to CoinGlass data, Bitcoin is on track to end Q3 with a modest 0.6% gain, and a 7% rise in September. Looking ahead, traders are hopeful for a bullish close to 2024.

As Quinten François, co-founder of WeRate, pointed out, “100% of election years had a green October, November, and December.” This historical trend gives Bitcoin traders reason to be optimistic for the months ahead.